Social Security Max 2025 Withholding Table - Maximum Social Security Tax 2025 Withholding Table Amil Maddie, But beyond that point, you'll have $1 in benefits withheld per $2 of earnings. Maximum Social Security Tax 2025 Withholding Table Cyndi Dorelle, In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600.

Maximum Social Security Tax 2025 Withholding Table Amil Maddie, But beyond that point, you'll have $1 in benefits withheld per $2 of earnings.

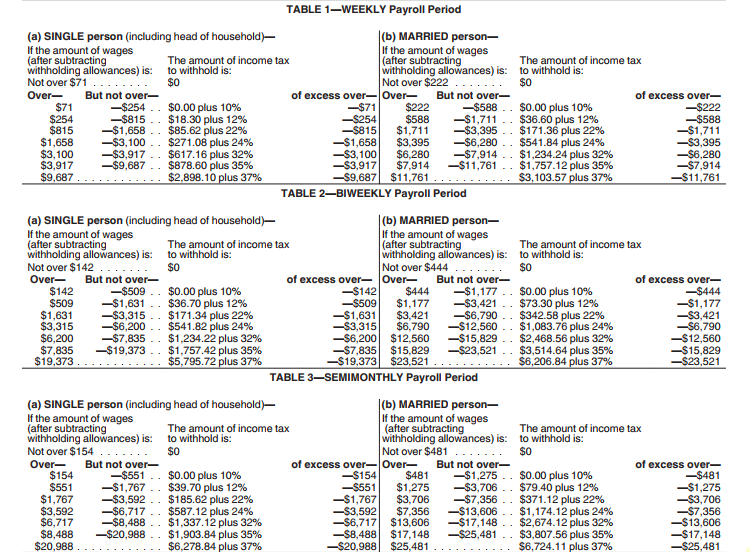

Social Security Tax Limit 2025 Withholdings Susy Zondra, Increase in each income bracket.

What Is Max Social Security Withholding 2025 Emyle Francene, Flat dollar amounts are not accepted.

Flat dollar amounts are not accepted. The 2025 and 2025 limit for joint filers.

Social Security Tax Limit 2025 Withholding Chart Kelli Melissa, The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2025 for leave taken after march 31, 2021, and.

Social Security Withholding 2025 Percentage Table Jewel Lurette, In 2025, you can earn up to $22,320 without having your social security benefits withheld.

2025 Maximum Social Security Withholding Kaila Mariele, It’s $4,873 per month if retiring at 70 and $2,710 for retirement at 62.

Max Social Security Tax 2025 Withholding Table Edithe Chryste, Here's a look at the most you can.

Maximum Ss Withholding 2025 Tessa Fredelia, But beyond that point, you'll have $1 in benefits withheld per $2 of earnings.

Social Security Max 2025 Withholding Table. In 2025, the social security tax limit rises to $168,600. Up to 85% of your social security benefits are taxable if:

Social Security Tax Limit 2025 Withholding Table Karen Marlane, For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025).